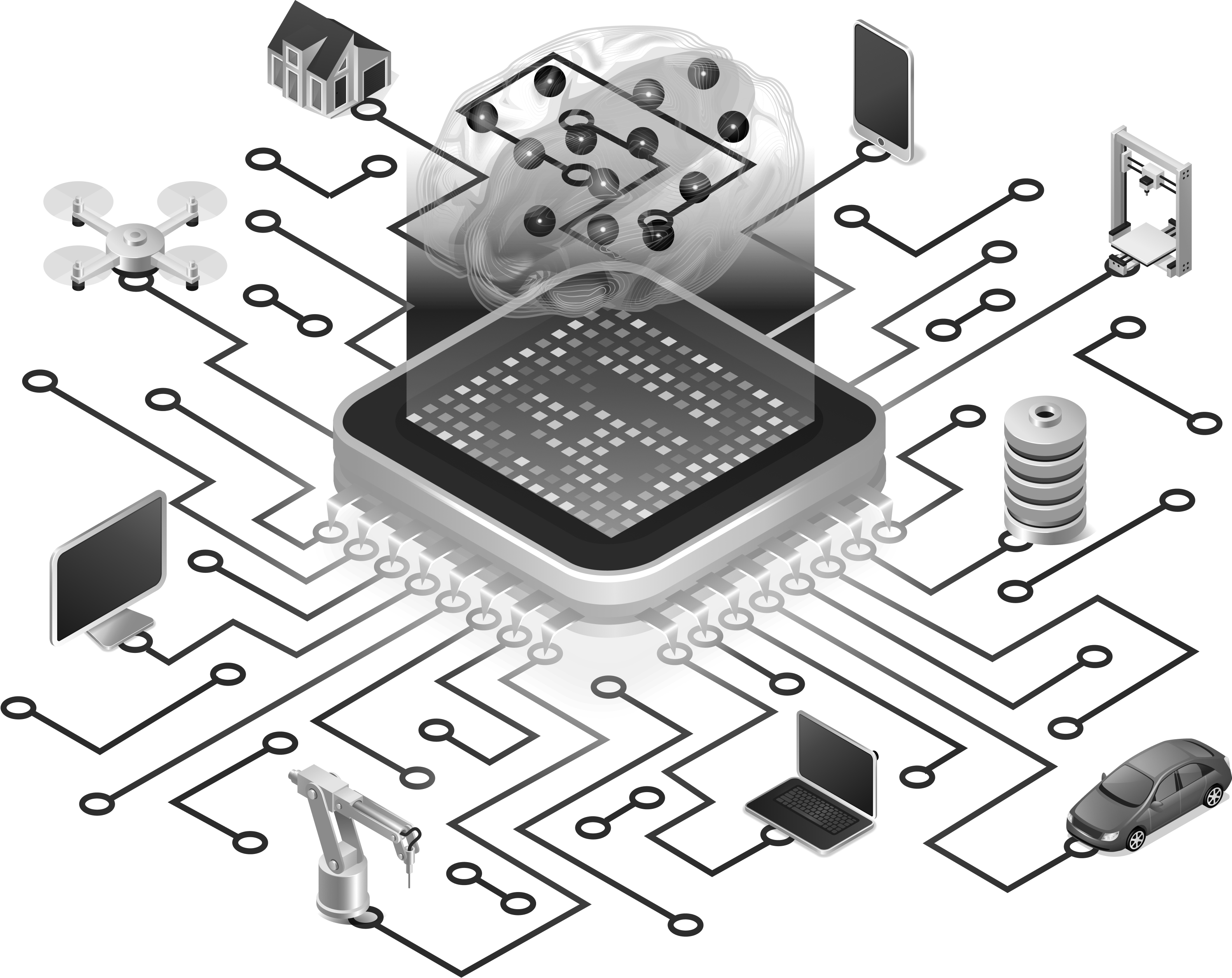

We accelerate Data and AI Turning Data into Insights

We transform your data into value, differentiation, and revenue

Our team of experienced data professionals help you with addressing any data challenges across business functions, technology platforms and domains. Our services can be customized for each client. No case is too complicated for us to handle and no assignment is too insignificant for us. To meet the world’s challenge, we offer both specific problem resolution with data as well as need based consulting resources.

OUR SERVICES

Data & Analytics Strategy

We celebrate what makes your business uniquely yours—your culture, your vision, your identity. Our focus is on unlocking the power of your greatest technical asset: your data.

Management & Governance

Thinking about implementing a PIM system? It's more than just another piece of software—it's a game-changer for how you manage and share product information.

Data Engineering & Analytics

In today’s data-driven economy, organisations face increasing challenges in accessing, integrating, and managing data distributed across multiple systems, platforms, and formats.

AI & Data Science

Our offerings cover the entire analytics spectrum: from data integration and visualization to predictive and prescriptive analytics.

Data Security

Modern organisations run on data—but with rising cyber threats, regulatory pressures, and AI-driven risks, securing that data has never been more critical.

Explore Our Services

Discover additional services designed to help your business grow, innovate, and achieve long-term success.

Let’s Make Data Work for You

We make your data work for your business. Simply that’s what we do...